Frugal Living Friday: Giving Tuesday and the Heart of Generosity

Frugal Living Friday: Giving Tuesday and the Heart of Generosity Home / Frugal Living Friday: Giving Tuesday and the Heart of Generosity Frugal Living Friday:

Hello friends, and welcome back to another Frugal Living Friday here at ASW Homestead!

Saving money isn’t always fun, but it also doesn’t have to feel painful or restrictive. A simple shift in habits such as trading convenience for creativity, or excess for simplicity can free up room in your budget while drawing you closer to a life of contentment.

Homesteading has taught us that small, intentional choices add up. Just like planting one seed at a time leads to a harvest, trimming a few expenses here and there can make a surprising difference in your finances. Here are seven everyday areas where you might be able to cut costs right now:

Are you paying for a health club you hardly use? Instead of spending $50–$75 a month, you can get plenty of exercise at home with a pair of walking shoes, a jump rope, or even second-hand dumbbells. Yard work, gardening, and farm chores also count as good workouts!

Family movie nights at the theater can run $40+ (and that’s before the popcorn). Instead, stream a family-friendly movie at home, pop your own popcorn, or borrow DVDs from the library. You’ll still make memories together — for a fraction of the cost.

If public transportation or carpooling is an option, it can save big on gas and parking. Even splitting rides with a neighbor a couple of days a week helps. Also, don’t forget to check your car insurance rates once in a while. The difference between providers can be hundreds of dollars a year.

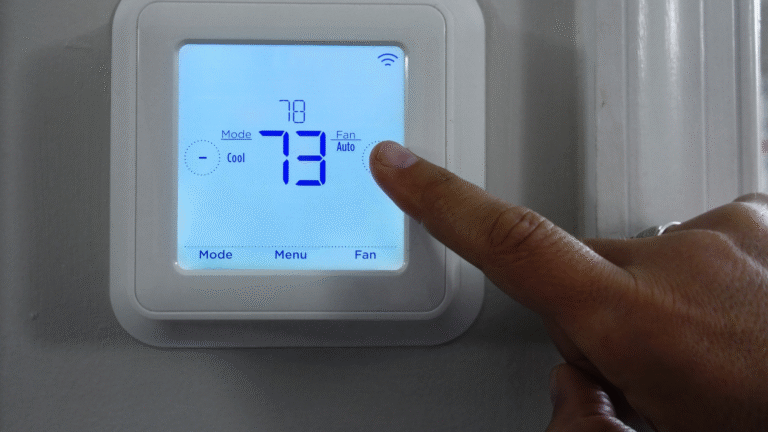

Small changes in heating and cooling add up. Dropping your thermostat three degrees in the winter or raising it three degrees in the summer can save nearly 10% on your bill. Cozy sweaters in winter and fans in summer help keep the whole family comfortable without breaking the bank.

There are often ways to save on medication:

Ask your doctor about generics.

Shop around — prices vary between pharmacies.

Use online or mail-order services for long-term prescriptions.

And of course, healthier habits can sometimes reduce the need for medications altogether (with your doctor’s guidance).

We all love a good latte, but buying coffee on the go adds up quickly — over $1,000 a year in many cases. Making your own coffee at home saves money and can become a cozy morning ritual. Brew a big pot, pour it into a thermos, and enjoy all day long.

Eating out is convenient, but it drains your wallet fast. Cooking at home is healthier, cheaper, and often more enjoyable. Try new recipes to avoid “food ruts” and invite friends over for dinner instead of going out. A pot of soup, fresh bread, and good company beats a crowded restaurant any day.

Saving money doesn’t mean living without joy. In fact, the opposite is true: when we stop spending on things that don’t truly matter, we make more room for what does — family, faith, and a life rooted in contentment.

So here’s this week’s challenge: take a look at your budget and pick one area you could trim back. Maybe it’s brewing coffee at home, maybe it’s lowering the thermostat, or maybe it’s finally canceling that unused subscription. Small steps can grow into big change.

👉 What’s one expense you’re ready to cut this month? Share your ideas in the comments — you never know who you might inspire!

Around here, we’re learning as we go—one season, one project, and one lesson at a time. I’m glad you’re along for the journey.

Frugal Living Friday: Giving Tuesday and the Heart of Generosity Home / Frugal Living Friday: Giving Tuesday and the Heart of Generosity Frugal Living Friday: